Blog > The Real Cost of Buying a Home in Shelby County, AL (2025 Edition)

So, you’re thinking about buying a home in Shelby County? First of all—great choice. This slice of Alabama is known for good schools, safe neighborhoods, and plenty of charm. But before you fall in love with that four-bedroom in Helena or the lakefront view in Columbiana, let’s talk numbers. Because in 2025, “how much” isn’t just about the listing price.

🏡 What Homes Are Going For Right Now

If you browse Zillow, you’ll see the average home value around $354,632. Redfin has the median sale price at $361,000. Realtor.com? They’re listing the median at $399,000, with sold prices closer to $387,000.

Why the spread?

- Average vs. Median: Averages can get pulled up by luxury homes; medians tell you what “typical” homes sell for.

- Listing vs. Sold: Listings are the asking price; sold is what buyers actually paid.

- Timing: Real estate data is like milk—it’s freshest when local and recent. February numbers may not match July’s.

Bottom line? Expect to shop in the mid-to-high $300Ks for a typical home.

💵 What You’ll Actually Pay

Buying a home is like going to a nice restaurant—you see the entrée price, but there’s tax, tips, drinks… and suddenly you’ve spent way more. Same here.

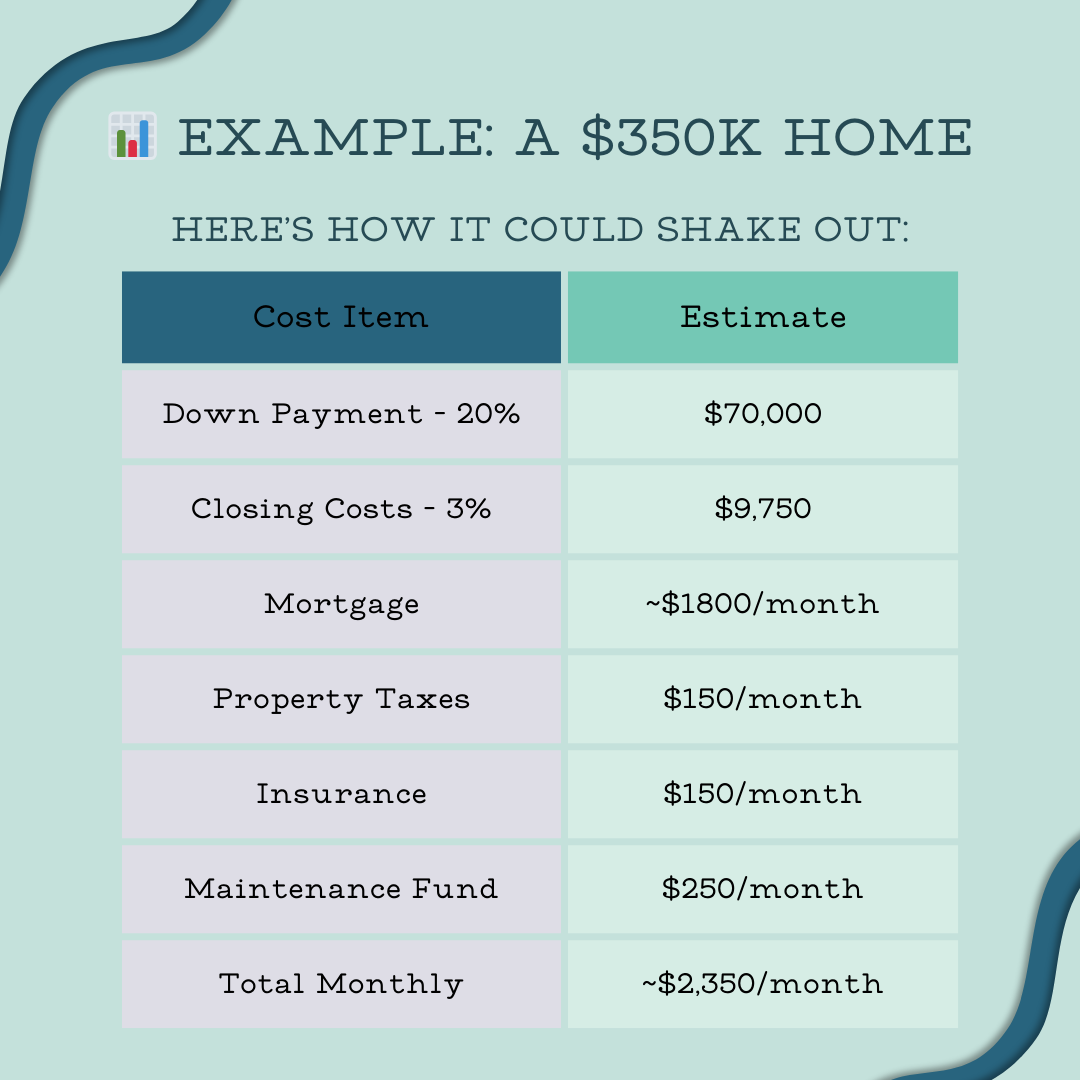

Upfront Costs

- Down payment: Could be as low as 3% or as high as 20%—on a $361K home, that’s anywhere from $10K to $72K.

- Closing costs: Usually 2–5% of the purchase price. That’s another $7K–$18K.

- Inspections/Appraisals: $500–$1,500.

Ongoing Costs

- Mortgage: Your biggest monthly bill. At recent rates, a $325K mortgage might run ~$1700/month.

- Property taxes: Shelby County’s effective tax rate is around 0.48%, which is low compared to national averages. That’s about $1,800/year, or $150/month.

- Home insurance: Around $1K–$2K/year.

- Maintenance: Rule of thumb is 1–3% of the home’s value per year—so budget $3,500–$10,000 annually.

And that’s before utilities or any HOA fees.

📝 What This Means for You

Shelby County homes are pricier than the Alabama state average (about $235K), but you’re paying for quality-of-life perks—strong schools, suburban convenience, and proximity to Birmingham without living in Birmingham.

The market in 2025 feels balanced: homes are selling for close to asking price, but there’s not a ton of inventory. Translation: shop smart and be ready to move when you find “the one.”

👍 Tips for Buyers in 2025

- Get pre-approved so you know your budget before you fall in love with a house. Connect with our preferred lenders for an all inclusive experience.

- Look at the monthly all-in cost, not just the sticker price or the interest rate.

- Work with a local agent—At 3 of a Kind Realty Group we live, work, and play in Shelby County and can help you find the perfect home for you!

- Don’t sleep on inspections—they’re your insurance against surprises.

- Be ready to act fast—good homes don’t sit around long here.

GET MORE INFORMATION